VIX Spike: Opportunity Or Threat? January 14 Stock Market Preview

We’re offering a New Year special that will end in two days: $300 off of the annual Portfolio Manager subscription, enter code NEWYEARS26 at checkout!

You can find today’s YouTube video by clicking Community at the top of our homepage. We take a look at SPX, QQQ, IWM, BTC, NFLX, and TSLA, so check it out if you have a few minutes!

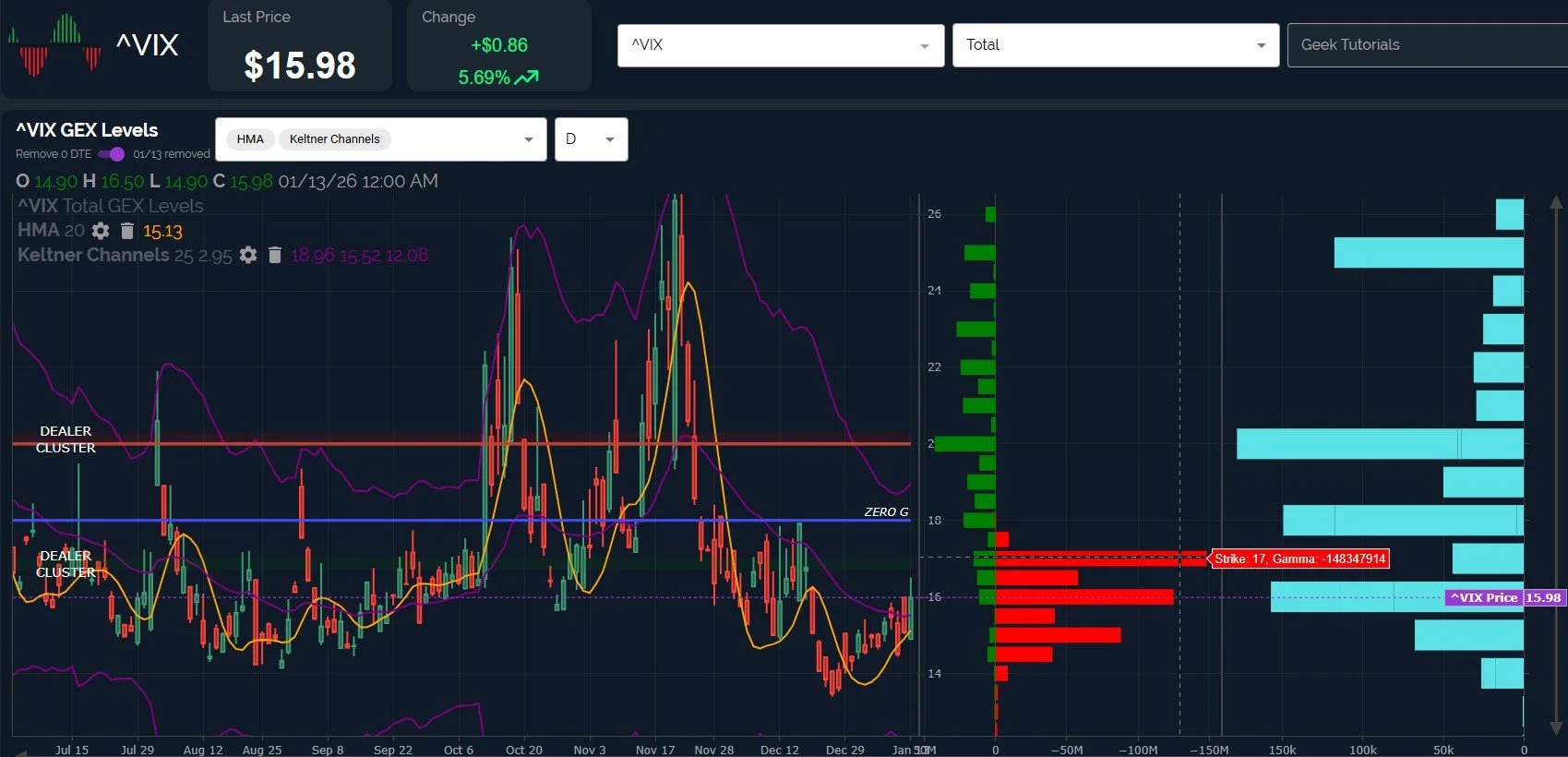

The VIX is bumping up against the 16 strike, an area we’ve noted as holding relative importance (in our opinion) to potentially opening the door to a continued spike to 20, or a ceiling that may see a drop back toward 14. VVIX is also rising, closing at 101, nearly an 8-point increase. What would a continued spike look like?

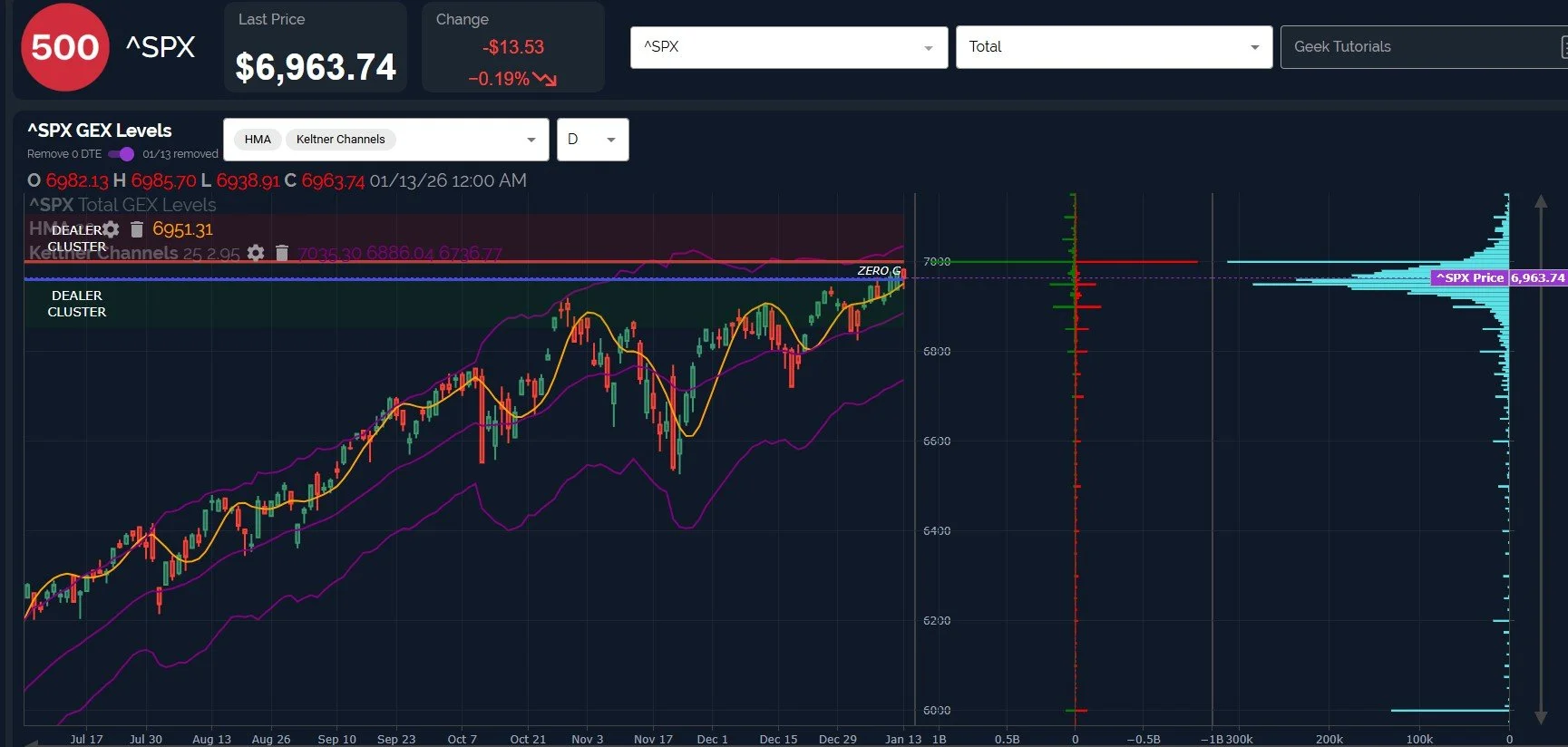

Gleaning additional information from the indices, SPX looks bullish, still maintaining a fairly precise upward trajectory along the rising Hull Moving Average. The Keltner channels look bullish, and we’re inching closer to 7000. Consolidation appears likely at 7000, though a spike higher could temporarily touch the 7030-7080 range before failing, in theory.

A loss of 6950 could see a relatively quick drop toward 6900, and likely a further push from the VIX.

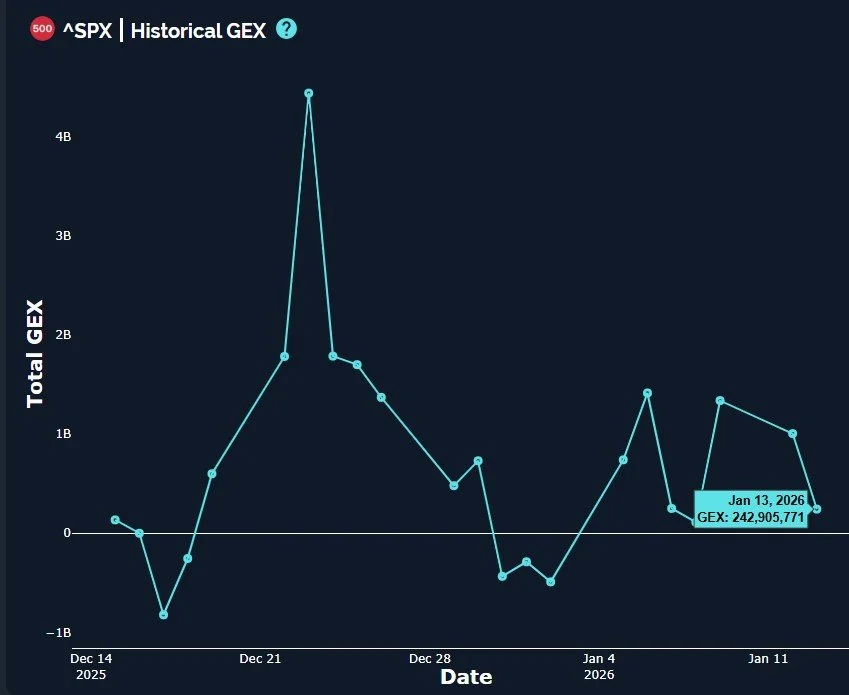

SPX net GEX has dropped two days in a row, fairly close to the negative GEX boundary. Today’s closing read of 243mm is effectively a neutral reading, in our view.

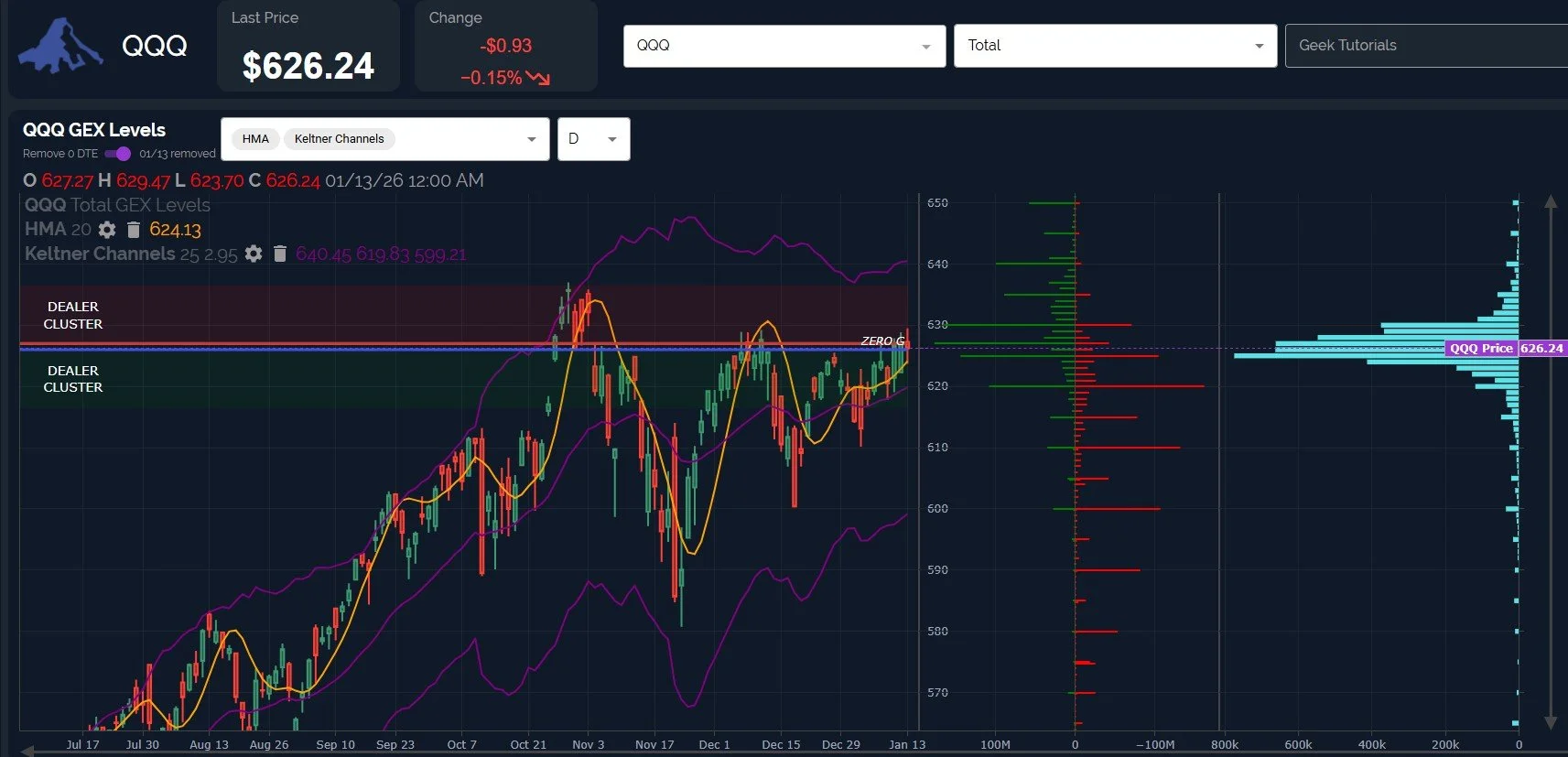

QQQ is looking more constructive despite underperforming SPX, with more room overhead (in percentage terms) to reach the upper Keltner channel, also matching with positive GEX clusters at 630-640.

A loss of 624 (and 620, ultimately) would start to look more bearish in the short run, though such a dip may initially be a good buying opportunity. This goes for SPX and IWM as well.

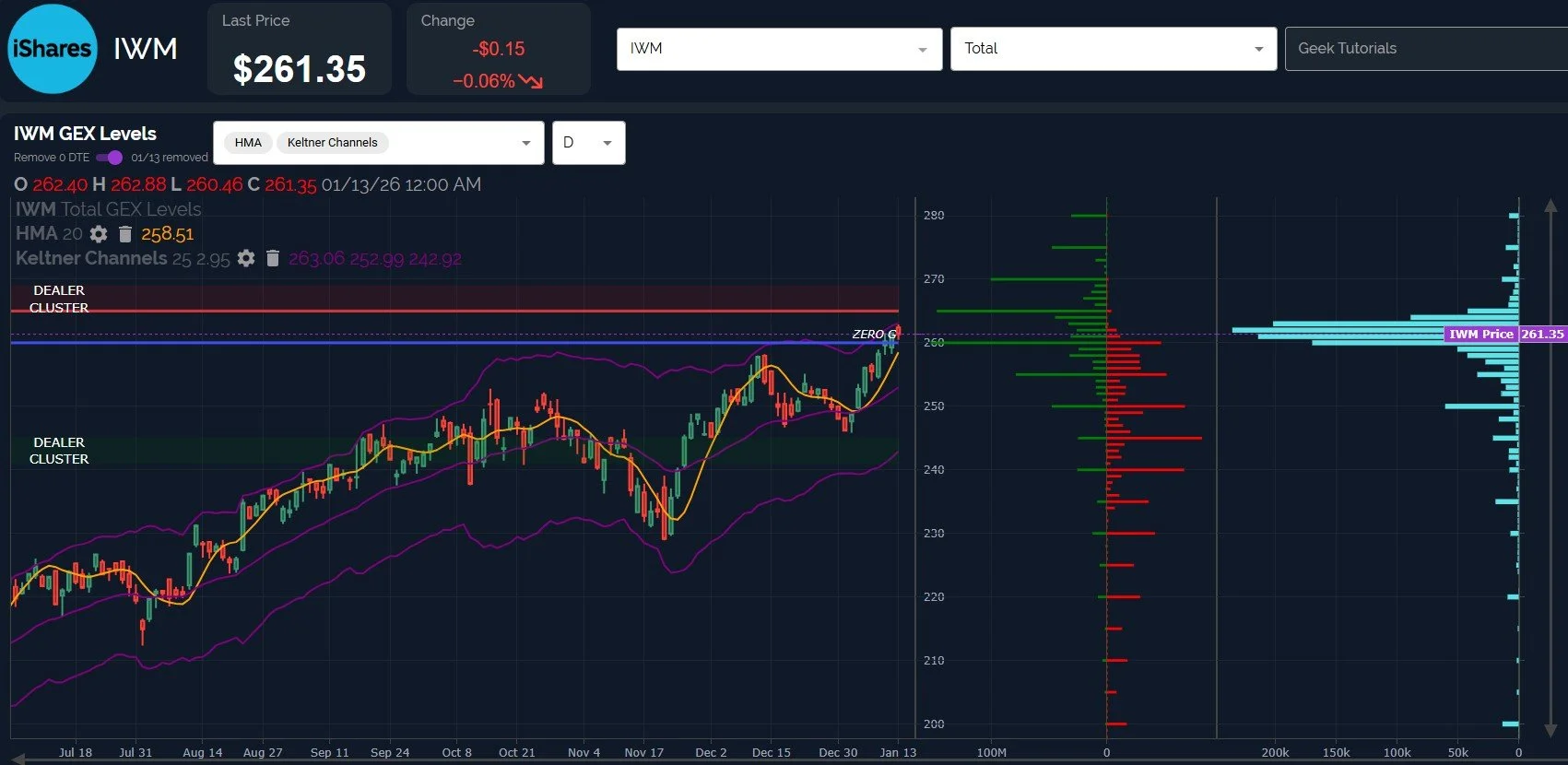

IWM still looks bullish, achieving a new high, though its price is pressing against the upper Keltner channel just shy of the large positive GEX at 265.

The upper Keltner channel is pushing higher though, so we likely aren’t far from a tag of 265. The rising Hull will soon intersect with IWM’s price without a constant move higher, at which point we may see some selling, if we don’t lose 258.50 immediately.

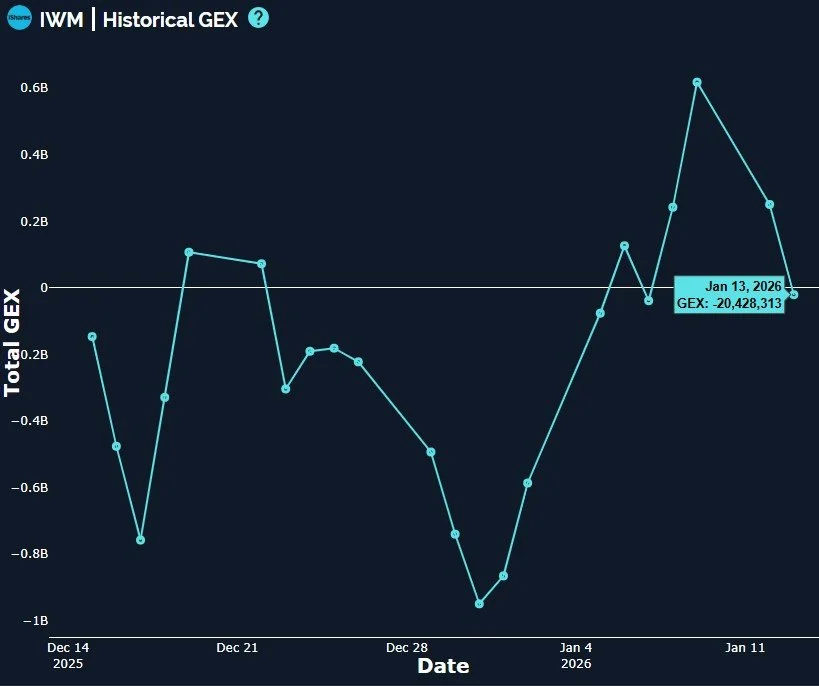

IWM’s net GEX dropped back into negative territory today, a consistent theme across the board, including QQQ. We need to watch whether or not this signals further weakness ahead, which we will hopefully see through the 0 DTE GEX developments throughout the day.

The VIX making higher highs and higher lows is really looking like a setup for a larger spike toward 20, though the big negative GEX at the 17 strike may be telling us to watch what happens at that level. 17 now appears to be a potential magnet for the VIX, and a revision to the 16 strike that we’ve been watching as a potential gateway.

With the overall charts looking bullish for indices, the negative divergences we’ve noted are likely signals that a buyable dip is coming, in our view. We will evaluate opportunities as we see more weakness in the indices with an eye toward a potential continued rise into late Spring.

If you haven’t joined us yet in Discord, go to our homepage and click on Community to enter our server! First-time guests receive a free 7-day trial of the premium Discord channels.

Thanks for being part of our community and know that we invite and appreciate your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.