Rallying On Borrowed Time?

You can check tonight’s YouTube video by clicking here, it’s only a few minutes long and we cover SPX, QQQ, IWM, LMT, AA, PLTR and more.

Yesterday we mentioned our perception that further upside had greater odds than downside in both the newsletter and YouTube, and so far, that upside is playing out. However, will this move run out of steam fairly quicky? Let’s take a look at some positives and some negatives for your consideration.

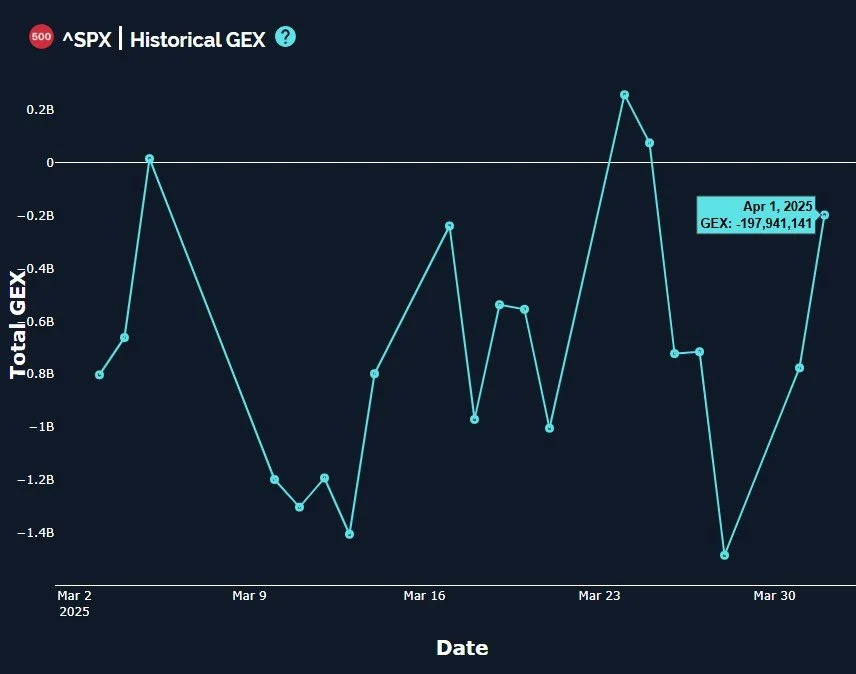

Starting with SPX, today’s rollercoaster down-up-down-up move may have caused indigestion for some. Ultimately, on the positive side, we do see some of the positive gamma exposure (GEX) being added back as we move up, though that is to be expected to some extent. I do wish the increase was more dramatic, but as the historical GEX graph shows below, the increase is still obviously positive.

Now for the possible problems: Lately, GEX highs like the one we saw on March 24 coincided with rebound highs, so is the increase we’re seeing now a sign of a sustainable rally ahead, or another short-term top? We also still see larger GEX clusters at lower strikes, and the Hull at 5683 above may prove to be at least formidable initial resistance.

We can say almost the same thing about QQQ, with the Hull at almost 480 coinciding with a large GEX cluster. I would like to see this Hull tested before the next decision is made about further upside or downside, though what I like is not something Ken Griffin and other participants think about, thus I am left with the need to react to what the next day brings.

QQQ saw a similar increase in GEX. SPX still looks more bullish, at least showing some GEX clusters that can be viewed without a microscope at higher strikes, but QQQ and IWM both look quite abysmal. Bulls can place hope in the negative GEX extremes that were reached days ago continuing to fuel a short squeeze, but the current positioning does not look like a large, sustainable bounce is currently in play. We will adjust accordingly if the following days prove otherwise.

The VIX gives cause for concern from another angle, namely that the Hull is curling upward and providing a theoretical “floor” of just under 19. To keep my rules simple and actionable, if any ticker is above the Hull, I lean tactically toward the long side, and this means the VIX is a buy in my general view, with a daily close below 18.59 as my stop. Based on GEX and the Hull, I might want to wait for 20 before going long the VIX personally (I currently have no position in the VIX), but indices still remaining below the Hull and the VIX above says we’re still looking at an overall downward bias, despite a short-term tactical view that we may push higher first. Let’s see what VIX does at 19-20 and SPX at the Hull and perhaps we can reconsider.

Here’s the Discord link if you haven’t joined us yet! Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! We rolled out backtested algos and chart indicators and we have more improvements on the way!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video after the market close today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.