Close Enough For A Bottom?

THE SPRING PROMO ALMOST OVER- the promo ends tomorrow! Enter code SPRING2025 at checkout to take advantage of a limited time offering of $300 off of the annual Portfolio Manager subscription.

You can check out our latest YouTube video by clicking here, it’s only a few minutes long and we cover what we view as the most likely possibilities for broader indices as well as a few individual tickers not covered in the newsletter tonight.

We had a nice rebound today, in fact, the gain from open to close was the largest for QQQ since March 21 and since February 28 for SPX. Intraday ranges were even larger. The weak open resulted in SPX reaching within almost 1% of our 5425 lower weekly Keltner mentioned yesterday, and gamma exposure data (GEX) shared in Discord proved valuable as we rebounded first to 5565 and then beyond to over 5600.

Our GEX levels chart below shows a lower Dealer Cluster zone that shifted higher early today, encompassing 5500-5600 instead of 5400-5500. We still see Keltners heading lower, though the upper Dealer Cluster zone is way up at 6100. Do we continue rebounding or drop from here? The Geeks generally see risk/reward favoring upside from here. My personal initial upside test that I’ll be hypothetically watching for further clues is the Hull moving average at roughly the 5700 SPX area. 5700 is now support turned resistance, though with the green box being what it is, I still like the idea of that 100 points materializing before we are potentially looking back into the abyss. Purple bars represent net GEX, the light blue represents option volume, by the way.

SPX negative GEX was cut in half, an encouraging sign for short-term bulls as well. Negative GEX results in exacerbated volatility in both directions, so dramatic upswings can still occur even in the context of a downtrend, but negative GEX lessening is one potential step toward this dynamic having less of an impact. Only time will tell in coming days as to whether or not we will drop back down again or not.

QQQ also saw a large rebound, though disappointingly (if you want my 2 cents) closing a mere $0.02 away from Friday’s close. In my view, the degree of buying and the better performance of SPX still leans toward greater odds of upside entering April. 481.93 represents the Hull.

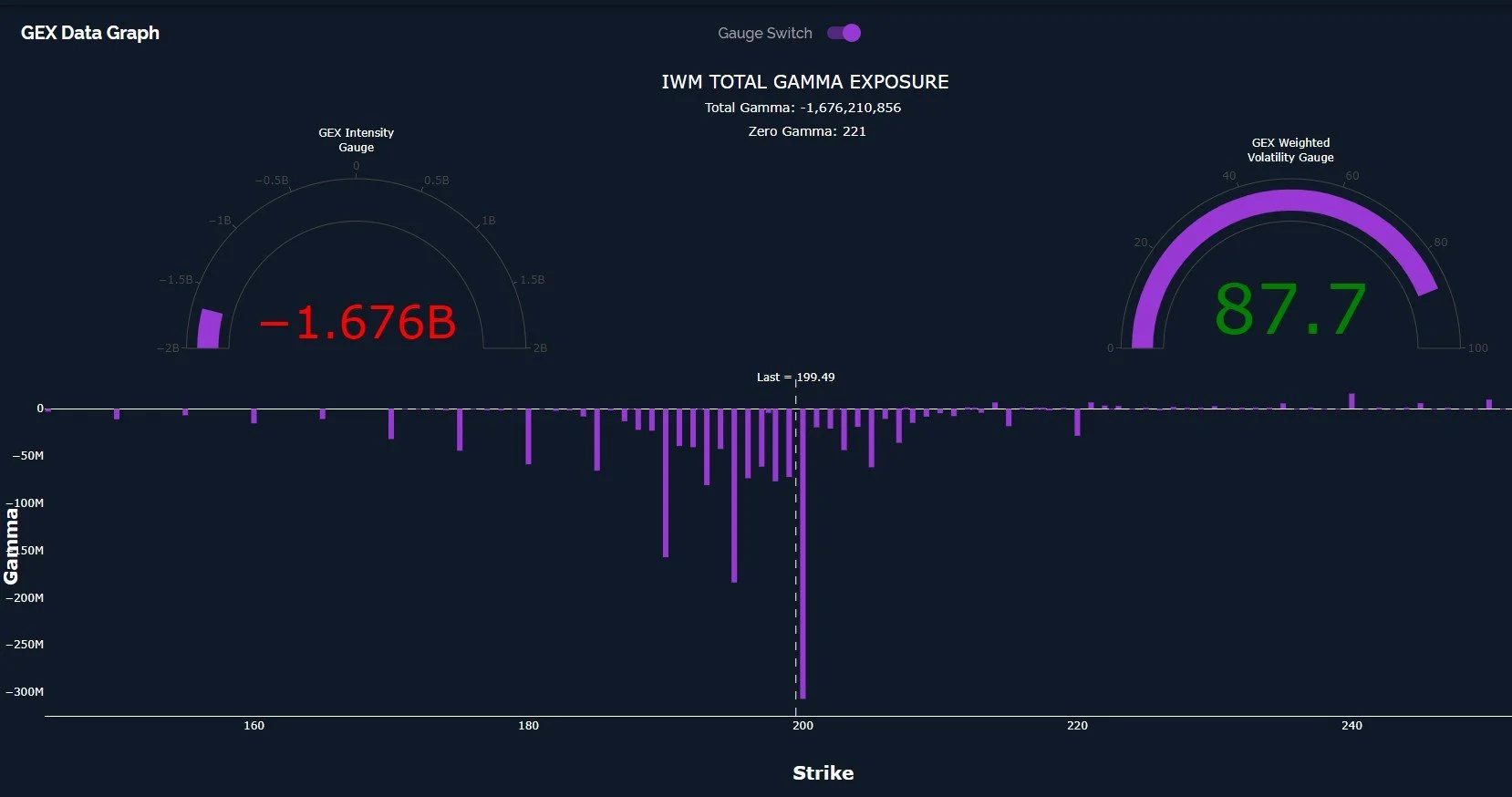

IWM also closed in disappointing fashion, roughly 1 point below Friday’s close, also printing a lower total net GEX number, somehow. Don’t let a rally get in the way of small cap bearishness! If we just saw an important low, I’d prefer to see IWM leading the charge higher, though I am also open to the possibility that perhaps IWM won’t lead the way this time.

We see virtually the same thing with QQQ, though QQQ looks even stronger, no surprise given its role in IWM is close to a negative extreme, which is a potential contrarian signal, and opening above 200 could possibly lead to a nice move higher. Join us in Discord tomorrow and we’ll discuss what we’re seeing with GEX developments intraday!

Here’s the Discord link if you haven’t joined us yet! Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful traders who chime in throughout the day, sharing ideas and opportunities as we see them.

If you’re interested in accessing our tools and analytics, be sure to check out our website! We rolled out backtested algos and chart indicators and we have more improvements on the way!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We recently posted a YouTube video after the market close today, and we have many other short videos, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.