Too Far, Too Fast? November 26 Stock Market Preview

NEWSLETTER ONLY Black Friday Special: Try our monthly Analyst subscription for ONLY $10 the first Month (First time subscribers only)! Enter code NEWSLETTER10 at checkout! ENDING after Cyber Monday, potentially never to return!

You can view today’s YouTube video here. We discuss QQQ, AMZN, META, and GOOGL, as well as the major indices, so check it out!

Indices continued the strong rebound from last week’s lows, sending the VIX lower while indices are testing key resistance.

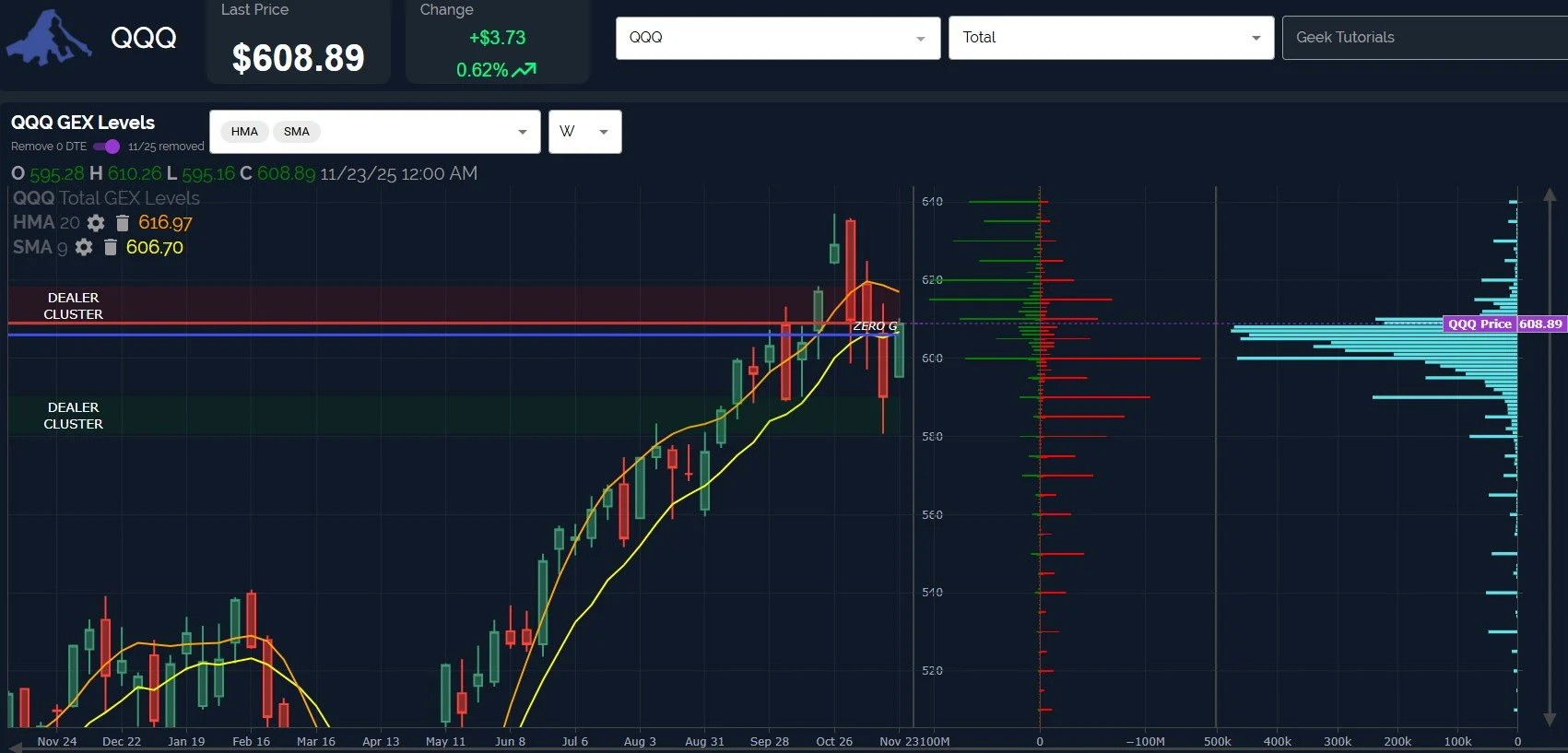

QQQ closed just above the weekly 9-period SMA, an important line given the close below the line last week, and the decline that was sparked by the close below the 9-SMA back in mid-February.

The Hull at 616.97 is the next potential resistance, if QQQ continues higher, also matching fairly closely to the big GEX cluster we see at 615.

Bulls aren’t out of the woods (at least until the next big GEX cluster) until QQQ overcomes the 615-620 area. A drop needs to hold the 600 zone to keep bullish dreams alive as well.

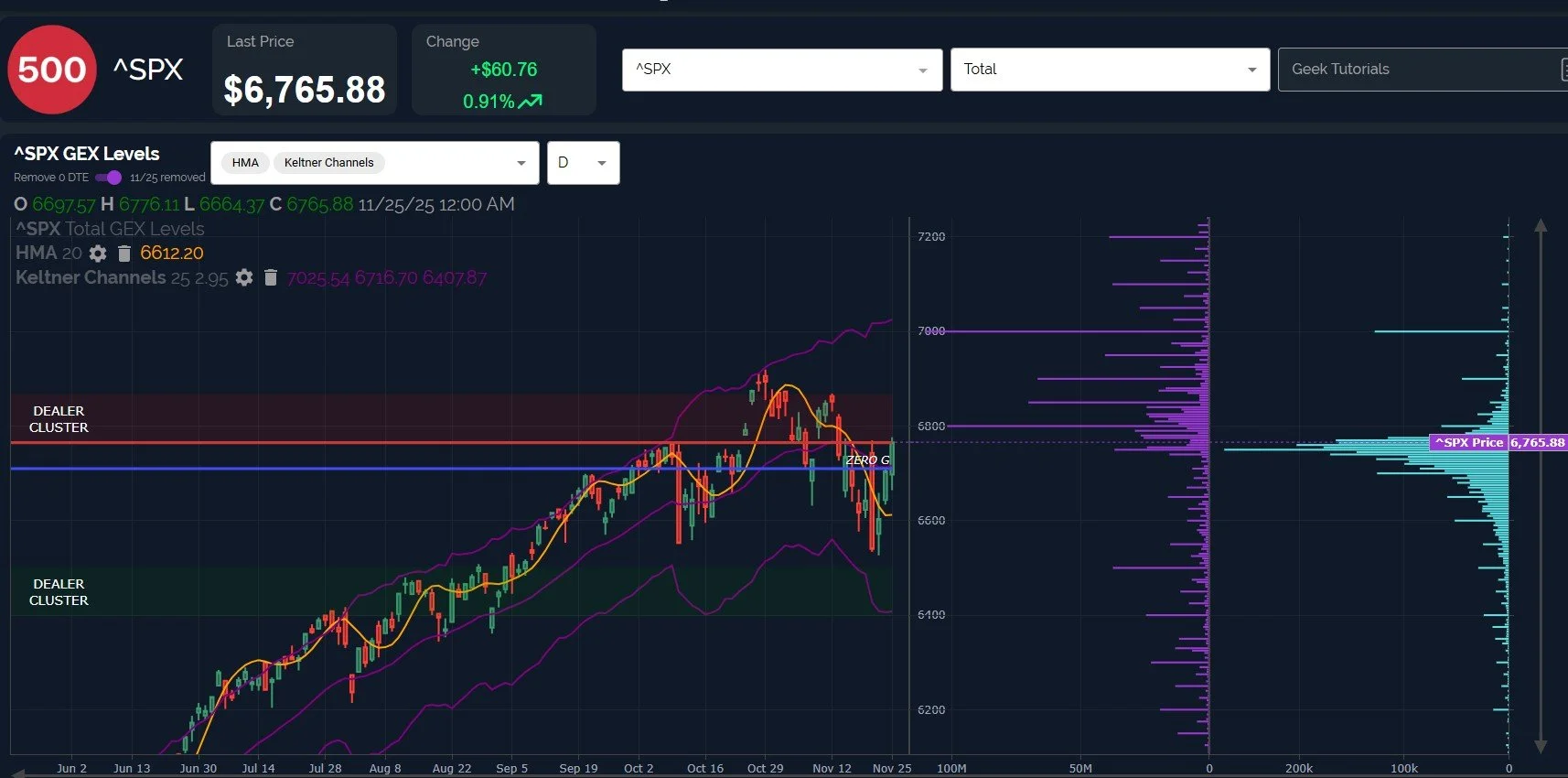

Looking at the SPX daily chart, which shares similarities with QQQ’s daily chart, we see price extended quite far above the Hull Moving Average. Such disparities typically have concluded with either price dropping or the moving average catching up to price, perhaps with a sideways consolidation by SPX.

Large net positive GEX clusters sit at the 6800 strike as well as the 7000 strike, with the 6800 strike constituting the upper Dealer Cluster zone, reflecting the importance of the level. Holding and closing above 6800 will likely see the upper zone shift toward 7000, while failing to overcome 6800 potentially means a move back to 6600-6700.

The VIX saw an early spike that tested and rejected the key 22-23 area where we said we would be watching for a reaction. The reaction favored market bulls, with swift rejection back to new lows for the VIX. The downtrend line is strong (based on Keltners) and even the 4-hour chart shows potential to drop back to 16, if we don’t begin a rebound here.

The VIX weekly chart shows rejection below the 9-SMA and below the key 19-20 GEX clusters.

The issue now is that the VIX is rapidly approaching the largest negative GEX clusters, especially those clusters at 17-18.

The lack of significant GEX clusters below 17 potentially imply that further VIX downside likely won’t be sustained, and perhaps the VIX will soon start a climb toward key lower highs (at a minimum).

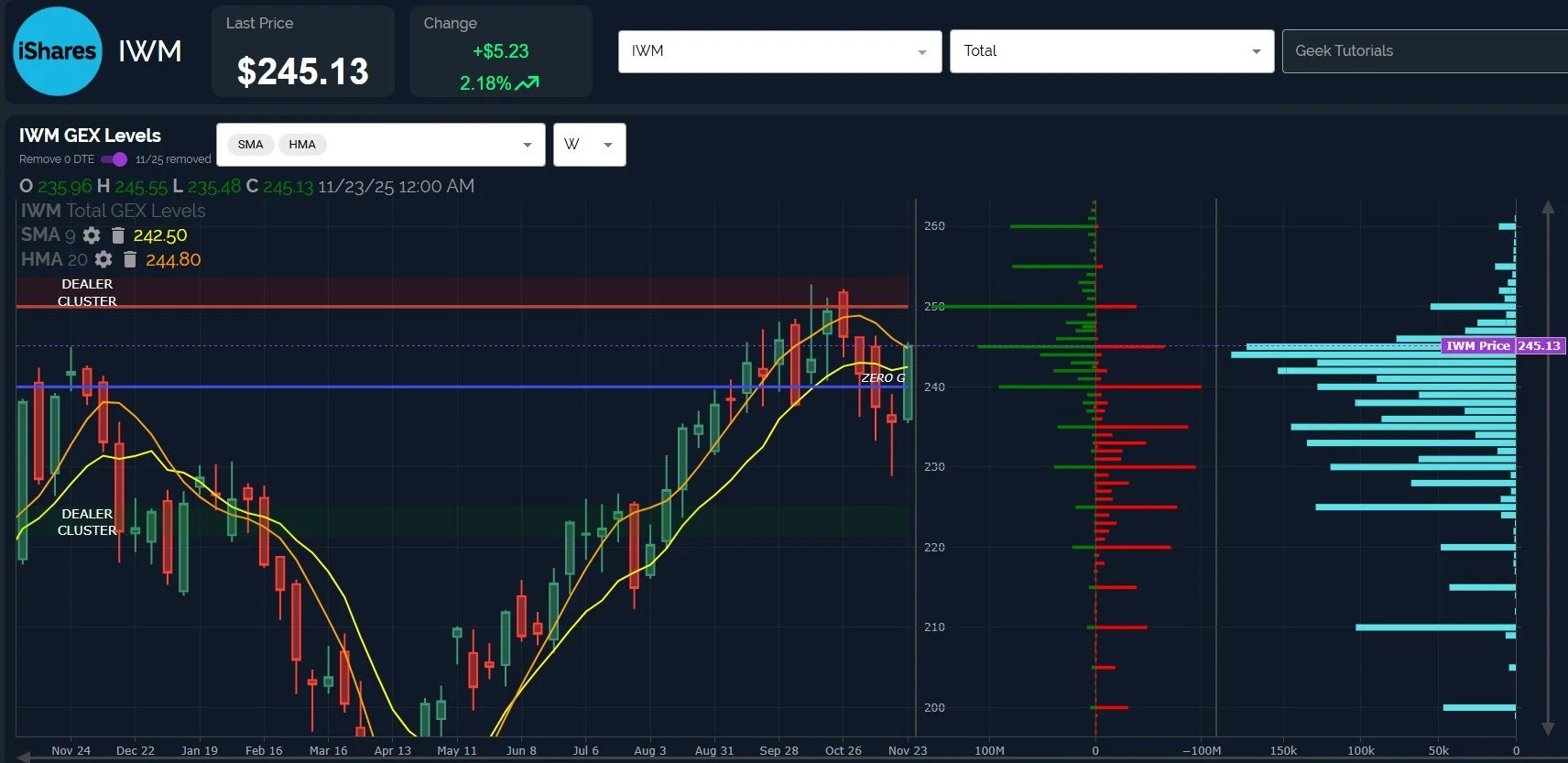

IWM has been leading the way, surpassing the key 9-SMA and now testing the important weekly Hull at 244.80.

The close above the line was unconvincing, especially given the huge move it took to just barely peek over the top, so we’ll be watching this 245-area to see if we go straight to 250 or if we see IWM pull back toward 230.

The daily chart shows the conflict of the large net positive GEX cluster at 250, though the recent price action shows the need for a pullback. Could we see a further spike higher, only to see key rejection back toward 230?

It’s entirely possible, so we’ll keep an eye out toward what happens tomorrow and Friday!

Here’s the link to our Discord server if you haven’t joined us yet! We have an active community of thoughtful and experienced traders who share their thoughts, and we share analysis every day as well.

You can join our discussion every day when we discuss markets in real-time via our Geeks Live livestream, now available to everyone for free via the homepage!

If you’re interested in accessing our tools and analytics, be sure to check out our website! We have a lot of updates in the works, and we have 2 primary membership tiers that you can read more about by clicking here: All About Our Memberships

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.