5900: So Close, I Can Almost Touch It

5900 is back in focus with SPX, a level we first identified as a high-probability target on Oct. 14. But do we see it hit now or later?

5900: SO Close, I Can Almost Touch It

5900 is back in focus with SPX, a level we first identified as a high-probability target on Oct. 14. But do we see it hit now or later?

VIX Expiration Approaches: What’s Next?

Monthly VIX options expire tomorrow morning premarket, with a lot of negative GEX at 21 and positive GEX at 22 rolling off. What happens next?

Approaching Earnings…And Resistance

The market has climbed the proverbial wall of worry, but with monthly option expiration coming this Friday, now we get to see if big players plan to catch anyone offsides as we approach strong resistance and a VIX with a positively shifting GEX structure.

Nearing An Inflection Point

The market has climbed the proverbial wall of worry, but with monthly option expiration coming this Friday, now we get to see if big players plan to catch anyone offsides as we approach strong resistance and a VIX with a positively shifting GEX structure.

Waiting For Friday?

The market couldn't decide what to do today, so we look toward a possible Friday move to finish off a positive week.

Upside Path Chosen. Permanent Pathway Or Pyrrhic Victory?

CPI and Jobless Claims have potential to ignite a rally to upper Keltner resistance, but we might also see a pullback soon, perhaps entirely premarket. We can't predict exact timing, so we need to have an eye toward caution despite the bullish move.

FOMC Blast-off Or Blues?

GEX didn't lead us astray today, and we also got the pop we were looking for after yesterday's drop. With a conga line of Fed speakers tomorrow and FOMC minutes, what's next? Today may have given us some clues.

Today A Drop Tomorrow A Pop?

We call this Week Of The Living Fed, with too many Fed speakers and a couple of important data points later in the week (CPI and PPI) as well as some bond auctions. How will the markets react?

Momentum Versus Seasonality: Who Wins?

Friday's momentum may continue a bit more, but how far? Potentially not much..

Foolish Hedging Or A Sign Of Impending Doom?

Volatility continues to rise, and we have jobless claims in the morning. But we do see some bullish potential in certain corners of the market.

Here’s The Bounce

The first trading day of October pretty much met our expectations, so now we watch gamma for clues as to the next move, Geopolitics are heating up and we have new inflation threats emerging.

Volatility Is Back(ish?)!

The first trading day of October pretty much met our expectations, so now we watch gamma for clues as to the next move, Geopolitics are heating up and we have new inflation threats emerging.

The Pin Is Over. Now What?

We are getting the VIX pullback we wanted to see, and we have a loaded week of inflation data and more. What's next?

Mission Accomplished! Almost…

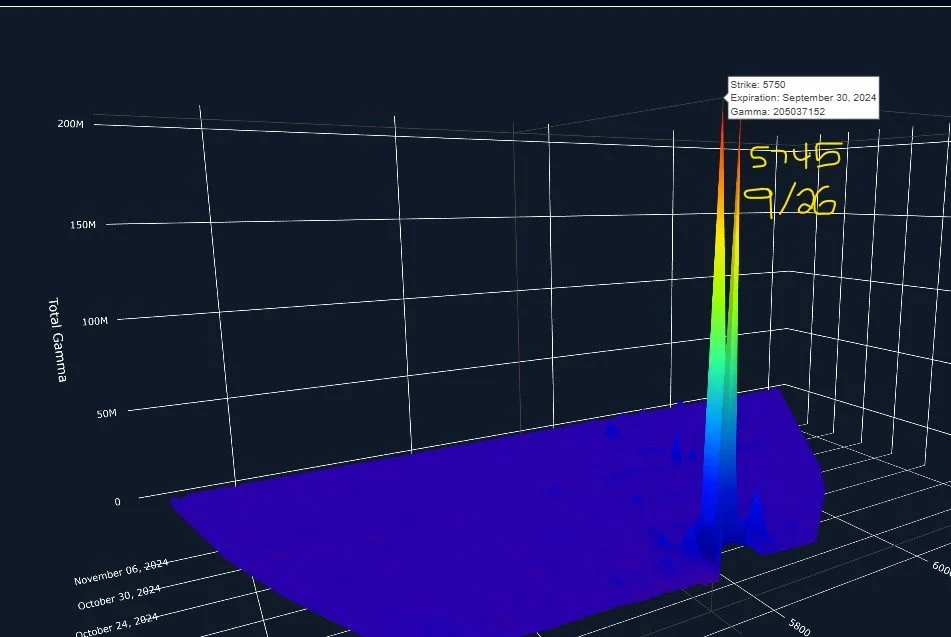

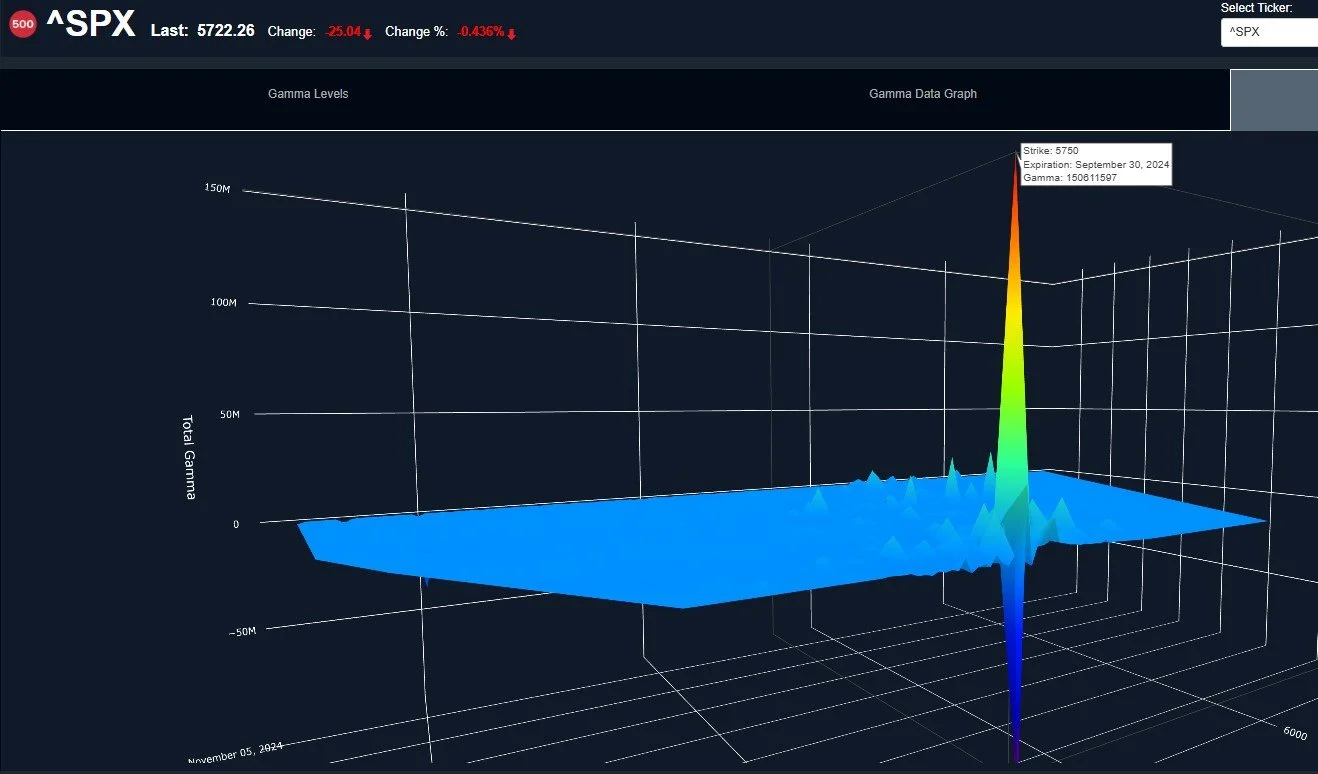

The GEX magnet at 5750 that we've noted for days finally hit with this morning's gap up before fading. Does this mean the bull move is over?

Running Out The Clock

It's starting to feel like participants are running out the clock into quarter-end. Today, we look at where we might see a little more volatility despite SPX seemingly being pinned to 5750 into 9/30.

One Stop Run To Go?

With election year seasonality looming, markets appear to be gearing up for what might be the final push higher in the short run.

VIX Below 16: Pushing On A String?

No relief for volatility as the VIX gets crushed to below 16 today. Does election year seasonality hold, or will this year be a rare inversion?

Approaching Quarter-End

We approach the end of the 3rd quarter this week into the following Monday. How will the market finish up (or down) for the quarter?

Bears On The Ropes, Jerome Pumping Hope

With monthly VIX expiration in the morning and the Fed's interest rate decision later, we are set for a potential shift in the volatility regime soon. Which direction is first?