Geek’s Daily Preview: Friday, August 2

REMINDER: $300 OFF THE ANNUAL PM SUBSCRIPTION ENDS SOON! ENTER SUMMER2024 AT CHECKOUT TO RECEIVE THE DISCOUNT! 1 More Available Subscriptions Remaining!

Yesterday we noted the failure of the S&P 500 to hold above the middle Keltner channel, leaving a wick overhead, and QQQ looked even weaker, despite the overall positive Fed day. Today saw an attempt to go higher again, but this time, the rejection led to a very red day by 2024 standards. IWM also had a sharp reversal downward after painting a mighty John Wick indecision candle yesterday. We were a couple of days early on the IWM drop, but we got it.

To briefly summarize our calls in the free Discord General Chat channel, we started the day with a bullish GEX picture, though QQQ lacked the same upside targets that SPY and SPX showed in terms of being meaningfully higher. We didn’t need more than 30 minutes before the GEX picture shifted before our eyes, flipping negative and showing 0 DTE GEX flow into lower option strike prices across various indices. If anyone had acted on the initial GEX setup, they potentially would have lost money, but the downside was significant AFTER the flip was indicated by GEX, giving ample time to make a nice profit on the short side.

Note that SPX dropped below the Hull Moving Average before rebounding to close just above it, showing the significance of the line. The intraday low was 5410, and we had 5400 as an early broadcast target once GEX flipped negative around 10 AM ET.

SPX does sit just above a Dealer Cluster Zone where we might see an attempted rebound.

SPX GEX Levels 7-29-24

Total GEX is back to negative territory, though really within a neutral range of +/- 1B.

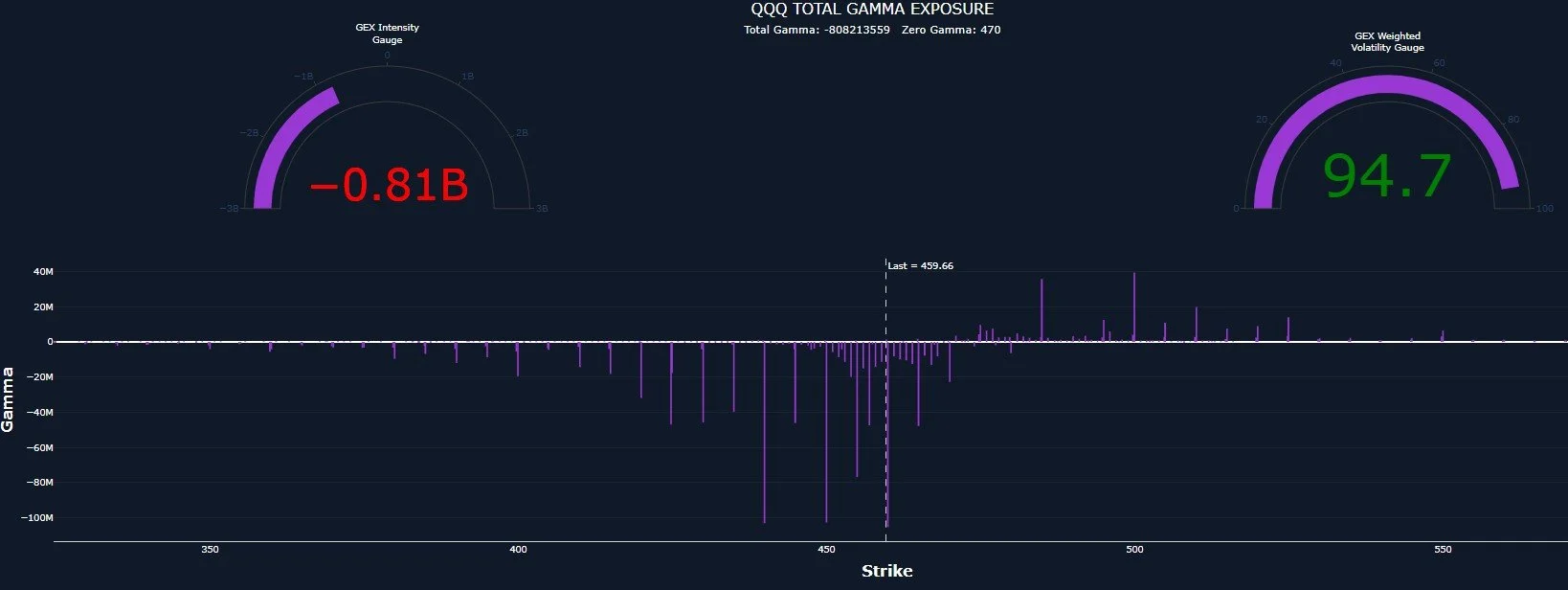

Now let’s shift to QQQ: despite yesterday showing a positive shift in total GEX, we posted the chart below and noted the big 440 GEX cluster that was spread out across a variety of expirations, from August 1st to August 16. 440 might have seemed far away yesterday, but today saw a one-day $16 drop for QQQ from high to low, bringing us to just one more day of decline like today to hit the target (not a prediction, just a relative comparison of necessary magnitude).

QQQ price action is weak, and the chart looks neutral at best, contrary to IWM. It’s oversold by some metrics on a smaller timeframe, but oversold doesn’t mean much to this market, so tread carefully going countertrend.

GEX has flipped negative (again) and we still see big GEX clusters at 450 and 440.

IWM finally saw a larger drop, getting very close to the 212-215 area where GEX had previously indicated to watch for possible reversal back up. The Keltner channel is in a steep uptrend, looking bullish.

GEX positioning says not quite so fast- we do still see GEX at 230, but notice the green Dealer Cluster Zone shifted lower to 200, previously about 5% higher. So we have to watch for these changes in GEX and use the historical tools at our disposal for context (more improvements coming up too).

What Are We Looking For On Friday, August 2?

AMZN, AAPL, and INTC dominated the after hours headlines today, seeing futures jump and then dip after their announcements. We tend to stay away from trading specific stocks right before earnings are announced, though sometimes price action still respects previously advertised GEX levels. Will we see a rebound in the morning after the 8:30 AM Employment Situation report? or do we drop even further? We will wait and see what the 0 DTE picture tells us after the market opens, no need to position for a binary move beforehand.