Weakness Leading Into FOMC

SUMMER PORTFOLIO MANAGER ANNUAL SUBSCRIPTION PROMO- We’re nearing the end of our offering $300 off of the annual Portfolio Manager subscription, which includes access to our full GEX dashboard, a 5-hour Geek University course, full Discord access including trade ideas, and our daily livestream. Enter code SUMMER2025 at checkout to lock in this deal in the last remaining days!

Today’s YouTube video can be viewed by clicking here. Check it out if you have a few minutes! In addition to reviewing major indices, we also cover GOOG/GOOGL, USO, SMCI, and the VIX.

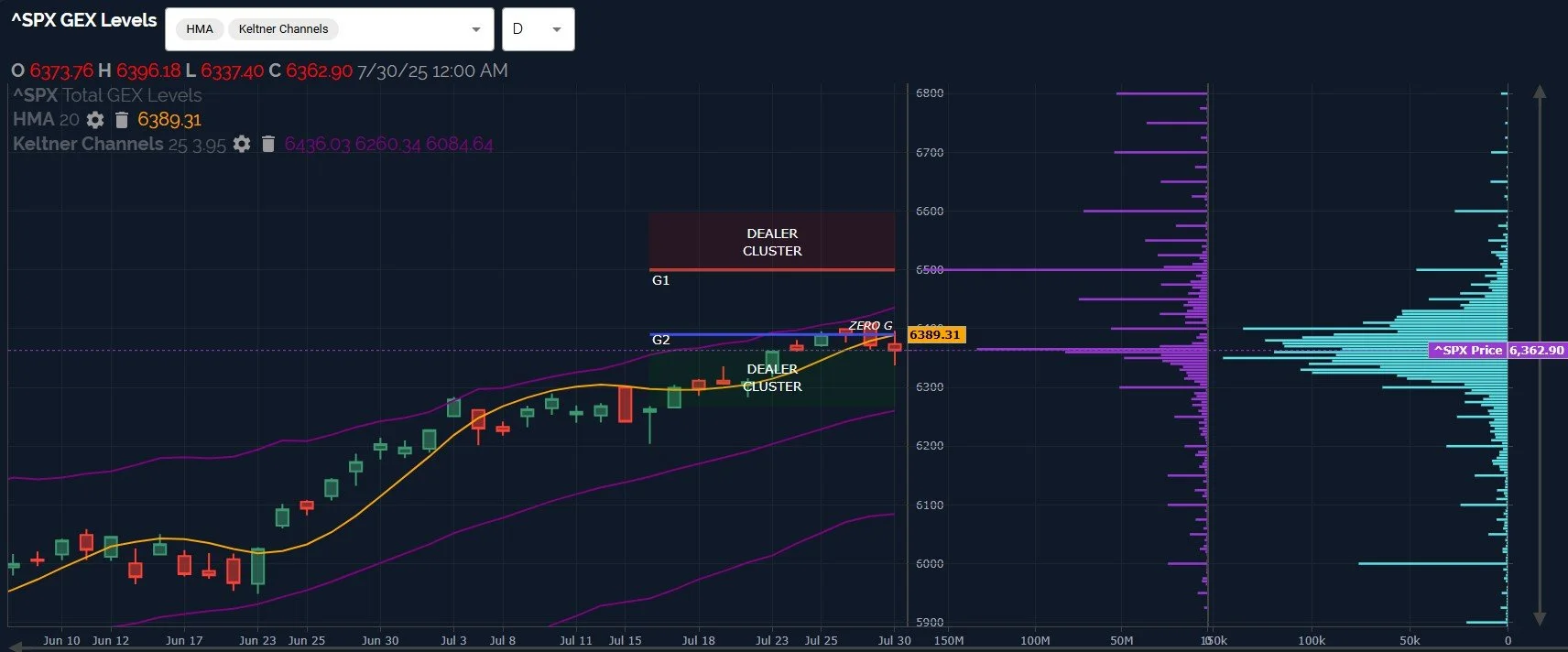

A repeat theme is starting to emerge for QQQ and SPX: A gap up and/or attempt to move higher, only to reject the effort intraday and sell off to some extent.

A divergence has emerged amongst ES and SPX: ES made its high 7/28 while SPX made its high 7/29.

The same divergence is seen comparing QQQ to NQ, with QQQ making a new high today while NQ futures saw their high on the 28th.

QQQ closed below the Hull Moving Average, though barely. The last time this happened was merely 5 trading sessions earlier, and QQQ continued higher thereafter, so a close below this close to the Hull is not definitive by any means.

QQQ also closed the cash session reflecting negative net GEX, a possible sign of weakness.

Participants are also holding off on increasing positive GEX above the 570-580 area, something we noted recently.

Such hesitancy could be strictly due to a desire to get beyond FOMC and earnings season (speculatively speaking), or it may signal advance warning of future price weakness, time will tell.

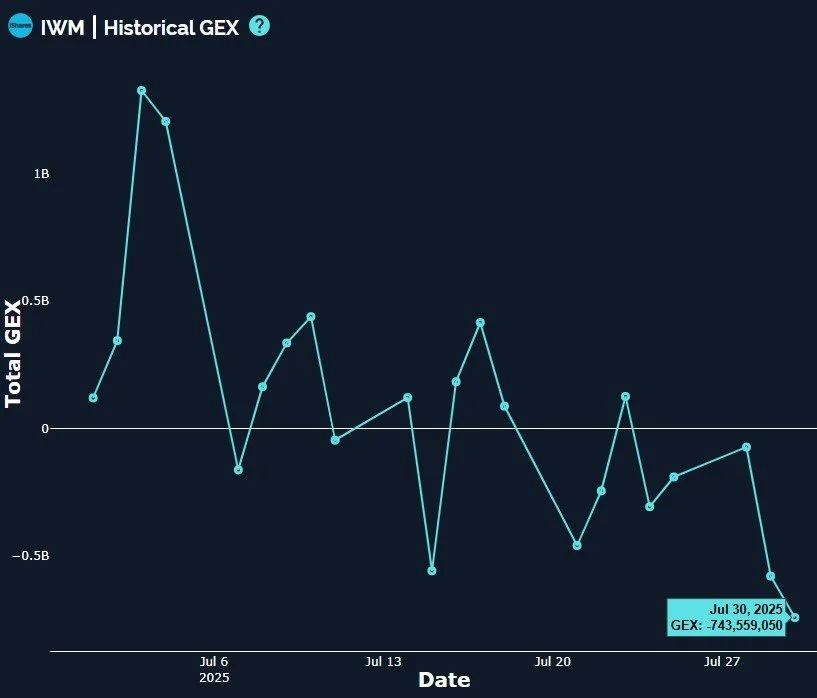

I find the signal value of IWM to be far more useful for my purposes, so let’s look at the Smalls. IWM has failed to make a higher high for 4 trading sessions, and today IWM closed below the Hull, far enough below to put me on high alert for a possible larger pullback.

With FOMC tomorrow, and big tech earnings after the bell, it’s hard to have maximum conviction for anything, but I will definitely be on alert to focus more on capital preservation tomorrow than on reaching for maximum gains.

Continuation lower may target 210-215, which I will view as a constructive buying opportunity.

Reaching 230 before a drop will bring price closer to the upper Keltner channel and the largest dealer cluster zone, at which point I would become more aggressive to reduce long exposure as long as the GEX above 230 is relatively muted (the purple horizontal bars).

IWM has spent 6 of the last 7 trading sessions in negative GEX territory, hardly a vote of confidence for the bulls.

The long volatility bias expressed in yesterday’s newsletter on the basis of the 4-hour Hull saw validation today, with the VIX rising to 16. Continuation higher should see close to 17, and holding above 17 will bring the daily chart into focus, with a target of VIX 20-25.

In addition to maintaining above key support areas on the 4-hour chart, the VIX is also now above the daily Hull for the first time in weeks (as far as closing above the Hull). This raises the odds (in my view) of a continued spike higher toward 20-25.

With FOMC tomorrow, PMI, ISM, and NFP Thursday/Friday, and earnings scattered throughout, we have plenty of excuses for more volatility, potentially in both directions, though the “pain trade” may have shifted at this point….Unless you think 40% in 3 months is normal, you might want to check your hedges. I have some good clippers if anyone needs some lawn tools..

Here’s the link to our Discord server if you haven’t joined us yet! Discord is our most active social media setting. Access is free for some channels, and new members have a 7-day trial within Discord to see how we operate. We have an active community of thoughtful and experienced traders who chime in throughout the day, and several channels dedicated to intraday and weekly trading.

If you’re interested in accessing our tools and analytics, be sure to check out our website! Mobile updates are now live for a better mobile experience and both subscription tiers have access to our full list of tickers!

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

We posted a YouTube video today, as mentioned at the beginning of the newsletter, and we have useful and educational playlists, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

Thanks for being part of our community and know that we invite your feedback!

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.