Exaggerated Rumors Of The VIX’s Death…

2024 BLACK FRIDAY SPECIAL! We are rolling out some EXCITING updates this week and we want you to be part of it! Take advantage of our temporary $300 discount on our annual Portfolio Manager-tier subscription by entering code BLACKFRIDAY at checkout! We’re making 5 spots available for this limited time promotion.

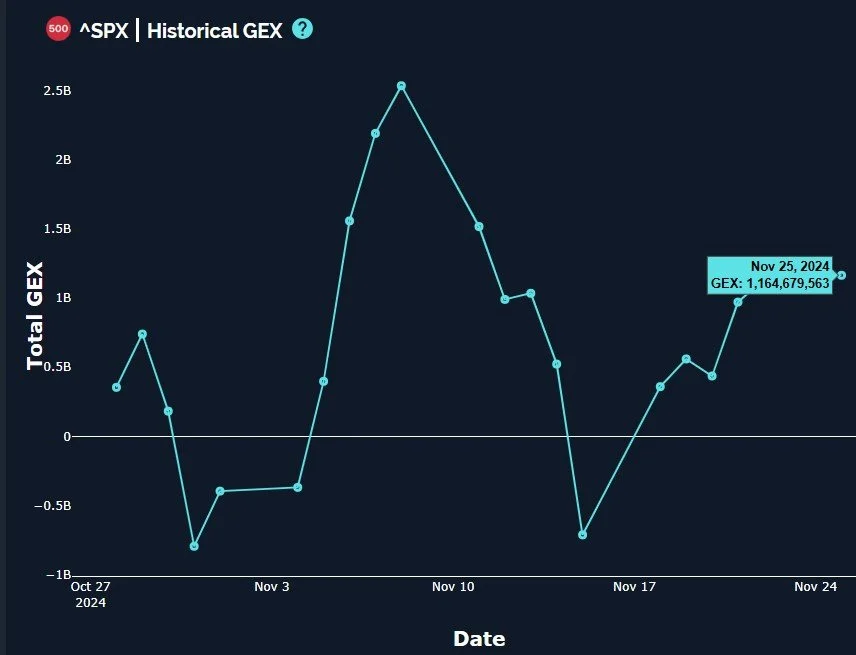

Last Thursday, we mentioned that the VIX was showing signs of a potential 14.50 retest, which presumably would coincide with SPX hitting 6000. We saw a little bait-and-switch with the gamma (GEX) picture Friday morning, with the 6000 GEX shifting to today (Monday, November 25), though at least we were given the heads up intraday before the weekend. Today was vindicating in that we saw both VIX 14.50 (14.54 actually) touched and SPX surpassed 6000 to test the upper Keltner around 6021 before dropping sharply, sending the VIX higher.

Today’s YouTube video goes over SPY, IWM, SNOW, META, USO, and COIN, so quite a diverse set of situations covered. Our videos are fairly short, so give our channel a look if you’re curious about recent market commentary and ideas as well as gamma (GEX) concepts explained.

As you can see on the VIX chart above, every bounce in volatility has been getting sold. However, notice how the Keltner channels have largely captured the approximate boundaries of the moves up and down, and we’re really close to the lower edge of the 2-hour Keltner, which is often an area where the VIX reverses. We touched the low of the day (LOD) at 14.54, then rebounded to over 15.70 in a significant reversal, then faded again, closing only slightly higher than the LOD.

The GEX Levels chart below shows that we’re slightly below a dealer cluster zone with a large GEX concentration at 15, and yet our highest volume today was at 20, followed by volume at 17. Both of these strikes surround the 2-hour Keltner top at 18.17. It’s not popular to predict pullbacks during the U.S.’s Thanksgiving week, and historically it has not been a bearish week, but the VIX is giving us a few reasons to maybe not enter a turkey and gravy coma just yet.

VIX GEX Levels: www.geeksoffinance.com

SPX came to within a few points of the top Keltner at 6030, reversing its rally while still closing above Friday’s close. The candle can be interpreted as a reversal or indecision candle, though we’re still above the Hull Moving Average, so my personal opinion is that I would have felt better about shorting close to the top Keltner than in the middle between the two..If we drop below 5953, I don’t see any support until 5879. None of the levels on my chart are completely bearish, in fact, I’d say as long as the drop maintains the trendline, it’s hard to count on bearish follow through at all. But we may see an interim pullback before this monster finally tops out some distance in the future.

SPX GEX continues to reflect bullish positioning, and while I didn’t share it today, our 3D graph shows 6055 and 6100 as prominent GEX clusters for December 20 and December 31. That’s a few weeks away (where did this year go?), leaving enough time for a VIX spike and then the final push into year end, assuming the current GEX positioning remains the same (it might not).

SPX Historical GEX: www.geeksoffinance.com

Overall, SPX still looks fairly bullish, though the GEX Levels chart below does add credence to the warning possibly signaled by the VIX that the pathway to bullish riches is not always a straight line. We’ve touched the G1 Dealer Cluster zone, where we might see some selling. It’s hard to pinpoint an exact spot for reversal strictly using GEX when the dealer cluster stretches nearly 100 points (still less than 2% though, amazingly), but from a swing trade or “big picture” perspective, this is not the area where I personally want to finally go max long and put too much faith in the ability for SPX to immediately climb deeper into the red box. It might, it might not…

SPX GEX Levels: www.geeksoffinance.com

The market closes early this Friday, and it’s completely closed Thursday, so we only have 2.5 trading days left in the week. We often see political bombshell filings late on a Friday evening, when few are paying attention, and I jokingly (or half jokingly) feel like a holiday week might be my preferred time to dump some bad inflation data or housing data. Is good good or is good bad? I don’t know anymore, maybe Jerome’s printer is all that matters. But we do have enough events crammed between tomorrow morning and Wednesday to jolt the market to a heightened level of volatility, if the market so chooses to move this week.

Econoday.com

Not to be a broken record, but we will take it day-by-day and we will be present during market hours this week, sharing any shifts in GEX positioning that we see. Join us in Discord tomorrow for our discussions around what’s happening as the day progresses!

If you’re interested in accessing our tools and analytics or taking advantage of our promotion (see the top of this newsletter), be sure to check out our website.

If you’re interested in learning more about our strategy and approach, we address all of these topics in our Geek University course which is included in all memberships.

Thanks for being part of our community and know that we invite your feedback!

We recently posted a YouTube video and we have many short videos for you to review where we cover a variety of predictions and educational topics.

The information provided by Geeks of Finance LLC is for educational purposes only and is not intended to be, nor should be construed as, an offer, recommendation or solicitation to buy or sell any security or instrument or to participate in any transaction or activity. Please view our Investment Adviser Disclaimer and Risk Disclosure.